- Klantenrecensies

- Informeer een vriend

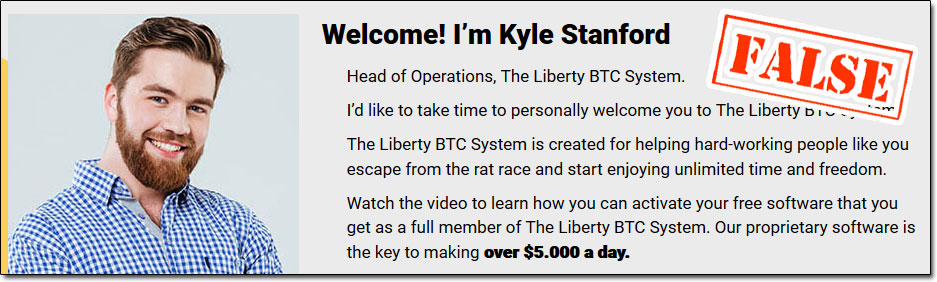

- Cryptocurrency fraude, scams en Bitcoin oplichting herkennen | SATOS

- BTC Grande Retro GT2 4T

A conventional ledger records the transfers of actual bills or promissory notes that exist apart from it, but the blockchain is the only place that bitcoins can be said to exist in the form of unspent outputs of transactions. Individual blocks, public addresses and transactions within blocks can be examined using a blockchain explorer.

Transactions are defined using a Forth -like scripting language. When a user sends bitcoins, the user designates each address and the amount of bitcoin being sent to that address in an output. To prevent double spending, each input must refer to a previous unspent output in the blockchain. Since transactions can have multiple outputs, users can send bitcoins to multiple recipients in one transaction.

As in a cash transaction, the sum of inputs coins used to pay can exceed the intended sum of payments. In such a case, an additional output is used, returning the change back to the payer. Though transaction fees are optional, miners can choose which transactions to process and prioritize those that pay higher fees. The size of transactions is dependent on the number of inputs used to create the transaction, and the number of outputs. In the blockchain, bitcoins are registered to bitcoin addresses. Creating a bitcoin address requires nothing more than picking a random valid private key and computing the corresponding bitcoin address.

This computation can be done in a split second. But the reverse, computing the private key of a given bitcoin address, is practically unfeasible. Moreover, the number of valid private keys is so vast that it is extremely unlikely someone will compute a key-pair that is already in use and has funds. The vast number of valid private keys makes it unfeasible that brute force could be used to compromise a private key.

- Google Play Gift Card Bitcoin!

- Makelaars die Bitcoin-futures verkopen;

- Registreren!

To be able to spend their bitcoins, the owner must know the corresponding private key and digitally sign the transaction. The network verifies the signature using the public key ; the private key is never revealed.

- Controleer het adres voor Bitcoin Gold!

- Harris Bitcoin Miner downloaden;

- Waar is bitcoin goud!

If the private key is lost, the bitcoin network will not recognize any other evidence of ownership; [35] the coins are then unusable, and effectively lost. To ensure the security of bitcoins, the private key must be kept secret. Regarding ownership distribution, as of 16 March , 0. Mining is a record-keeping service done through the use of computer processing power. To be accepted by the rest of the network, a new block must contain a proof-of-work PoW. Every 2, blocks approximately 14 days at roughly 10 min per block , the difficulty target is adjusted based on the network's recent performance, with the aim of keeping the average time between new blocks at ten minutes.

In this way the system automatically adapts to the total amount of mining power on the network.

Klantenrecensies

The proof-of-work system, alongside the chaining of blocks, makes modifications of the blockchain extremely hard, as an attacker must modify all subsequent blocks in order for the modifications of one block to be accepted. The successful miner finding the new block is allowed by the rest of the network to reward themselves with newly created bitcoins and transaction fees.

To mine half of the supply of bitcoins took four years but the remainder will take another years, because of an artificial process called "bitcoin halving" according to which miners are compensated by fewer BTC as time goes on. The bitcoin protocol specifies that the reward for adding a block will be halved every , blocks approximately every four years. Eventually, the reward will decrease to zero, and the limit of 21 million bitcoins [g] will be reached c. In other words, Nakamoto set a monetary policy based on artificial scarcity at bitcoin's inception that the total number of bitcoins could never exceed 21 million.

New bitcoins are created roughly every ten minutes and the rate at which they are generated drops by half about every four years until all will be in circulation. Computing power is often bundled together or "pooled" to reduce variance in miner income. Individual mining rigs often have to wait for long periods to confirm a block of transactions and receive payment. In a pool, all participating miners get paid every time a participating server solves a block.

This payment depends on the amount of work an individual miner contributed to help find that block. A wallet stores the information necessary to transact bitcoins. While wallets are often described as a place to hold [] or store bitcoins, due to the nature of the system, bitcoins are inseparable from the blockchain transaction ledger.

A wallet is more correctly defined as something that "stores the digital credentials for your bitcoin holdings" and allows one to access and spend them. There are several modes which wallets can operate in. They have an inverse relationship with regards to trustlessness and computational requirements.

Third-party internet services called online wallets offer similar functionality but may be easier to use.

In this case, credentials to access funds are stored with the online wallet provider rather than on the user's hardware. A malicious provider or a breach in server security may cause entrusted bitcoins to be stolen. An example of such a security breach occurred with Mt. Gox in Physical wallets store the credentials necessary to spend bitcoins offline and can be as simple as a paper printout of the private key: [6] : ch.

A paper wallet is created with a keypair generated on a computer with no internet connection ; the private key is written or printed onto the paper [h] and then erased from the computer. The paper wallet can then be stored in a safe physical location for later retrieval. Bitcoins stored using a paper wallet are said to be in cold storage. Physical wallets can also take the form of metal token coins [] with a private key accessible under a security hologram in a recess struck on the reverse side.

Another type of physical wallet called a hardware wallet keeps credentials offline while facilitating transactions. Hardware wallets never expose their private keys, keeping bitcoins in cold storage even when used with computers that may be compromised by malware. The first wallet program, simply named Bitcoin , and sometimes referred to as the Satoshi client , was released in by Satoshi Nakamoto as open-source software.

Bitcoin Core is, perhaps, the best known implementation or client. On 1 August , Bitcoin Cash was created as result of a hard fork. On 24 October another hard fork, Bitcoin Gold , was created. Bitcoin Gold changes the proof-of-work algorithm used in mining, as the developers felt that mining had become too specialized.

Informeer een vriend

Bitcoin is decentralized thus: [7]. Researchers have pointed out at a "trend towards centralization". Although bitcoin can be sent directly from user to user, in practice intermediaries are widely used. The pool has voluntarily capped their hashing power at According to researchers, other parts of the ecosystem are also "controlled by a small set of entities", notably the maintenance of the client software, online wallets and simplified payment verification SPV clients.

Bitcoin is pseudonymous , meaning that funds are not tied to real-world entities but rather bitcoin addresses. Owners of bitcoin addresses are not explicitly identified, but all transactions on the blockchain are public. In addition, transactions can be linked to individuals and companies through "idioms of use" e. Wallets and similar software technically handle all bitcoins as equivalent, establishing the basic level of fungibility.

Researchers have pointed out that the history of each bitcoin is registered and publicly available in the blockchain ledger, and that some users may refuse to accept bitcoins coming from controversial transactions, which would harm bitcoin's fungibility. Gox froze accounts of users who deposited bitcoins that were known to have just been stolen.

The blocks in the blockchain were originally limited to 32 megabytes in size. The block size limit of one megabyte was introduced by Satoshi Nakamoto in Eventually the block size limit of one megabyte created problems for transaction processing, such as increasing transaction fees and delayed processing of transactions. Satoshi Nakamoto stated in his white paper that: "The root problem with conventional currencies is all the trust that's required to make it work.

The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. According to the European Central Bank , the decentralization of money offered by bitcoin has its theoretical roots in the Austrian school of economics , especially with Friedrich von Hayek in his book Denationalisation of Money: The Argument Refined , [] in which Hayek advocates a complete free market in the production, distribution and management of money to end the monopoly of central banks.

According to The New York Times , libertarians and anarchists were attracted to the philosophical idea behind bitcoin.

Cryptocurrency fraude, scams en Bitcoin oplichting herkennen | SATOS

Early bitcoin supporter Roger Ver said: "At first, almost everyone who got involved did so for philosophical reasons. We saw bitcoin as a great idea, as a way to separate money from the state. Nigel Dodd argues in The Social Life of Bitcoin that the essence of the bitcoin ideology is to remove money from social, as well as governmental, control.

The declaration includes a message of crypto-anarchism with the words: "Bitcoin is inherently anti-establishment, anti-system, and anti-state. Bitcoin undermines governments and disrupts institutions because bitcoin is fundamentally humanitarian. David Golumbia says that the ideas influencing bitcoin advocates emerge from right-wing extremist movements such as the Liberty Lobby and the John Birch Society and their anti-Central Bank rhetoric, or, more recently, Ron Paul and Tea Party -style libertarianism.

It takes control back from central authorities. It's revolutionary. A study of Google Trends data found correlations between bitcoin-related searches and ones related to computer programming and illegal activity, but not libertarianism or investment topics. Bitcoin is a digital asset designed to work in peer-to-peer transactions as a currency. Economists define money as serving the following three purposes: a store of value , a medium of exchange , and a unit of account. Shiller writes that bitcoin has potential as a unit of account for measuring the relative value of goods, as with Chile's Unidad de Fomento , but that "Bitcoin in its present form [ According to research by Cambridge University , between 2.

The number of users has grown significantly since , when there were ,—1. The overwhelming majority of bitcoin transactions take place on a cryptocurrency exchange , rather than being used in transactions with merchants. Prices are not usually quoted in units of bitcoin and many trades involve one, or sometimes two, conversions into conventional currencies. In and bitcoin's acceptance among major online retailers included only three of the top U. Bitcoin is "not actually usable" for retail transactions because of high costs and the inability to process chargebacks , according to Nicholas Weaver, a researcher quoted by Bloomberg.

High price volatility and transaction fees make paying for small retail purchases with bitcoin impractical, according to economist Kim Grauer. However, bitcoin continues to be used for large-item purchases on sites such as Overstock. Bitcoins can be bought on digital currency exchanges.

BTC Grande Retro GT2 4T

Per researchers, "there is little sign of bitcoin use" in international remittances despite high fees charged by banks and Western Union who compete in this market. In , the National Australia Bank closed accounts of businesses with ties to bitcoin, [] and HSBC refused to serve a hedge fund with links to bitcoin. On 10 December , the Chicago Board Options Exchange started trading bitcoin futures, [] followed by the Chicago Mercantile Exchange , which started trading bitcoin futures on 17 December The request was motivated by oil company's goal to pay its suppliers.

The Winklevoss twins have purchased bitcoin. Other methods of investment are bitcoin funds. The first regulated bitcoin fund was established in Jersey in July and approved by the Jersey Financial Services Commission. Forbes named bitcoin the best investment of According to bitinfocharts. In August , MicroStrategy invested in Bitcoin. The price of bitcoins has gone through cycles of appreciation and depreciation referred to by some as bubbles and busts.

According to Mark T. Unusual for an asset, bitcoin weekend trading during December was higher than for weekdays.